Teaching children about money doesn’t have to feel like a chore. When you combine hands-on activities with playful learning, kids develop essential life skills while having fun. Financial education starts with the basics—recognizing coins, understanding their values, and counting different amounts—but it quickly evolves into critical thinking about saving, spending, and managing money wisely.

By incorporating games and activities into everyday situations, you help children build confidence with money math while preparing them for real-world financial decision-making.

Practice and Master Money Counting Skills

Building confidence with coins requires repetition, but practice doesn’t have to be boring. The key is creating varied activities that keep children engaged while reinforcing core concepts.

Activities to Count Like Coins

Start with sorting exercises that help young children distinguish between different coins. Give your child a mixed pile of pennies, nickels, dimes, and quarters, then ask them to separate each type into groups. This simple activity teaches visual recognition before introducing values.

Once they can identify coins reliably, introduce counting exercises:

Penny counting chains: Have children count out exactly 10 pennies, then 20, then 50. This reinforces counting by ones and helps them understand that 100 pennies equals one dollar.

Nickel counting: Count nickels by fives (5¢, 10¢, 15¢, 20¢, 25¢). Many children find skip-counting easier when they can touch each coin as they count.

Dime mastery: Practice counting by tens. Point out that 10 dimes make one dollar, creating a clear connection between coins and paper money.

Quarter challenges: Start with two quarters making 50¢, then build up to four quarters equaling $1.00.

A study published in the Saje Journals found that children who practiced coin counting through tactile activities showed 34% better retention than those who only worked with worksheets. Use real money whenever possible—the weight and texture of actual coins creates stronger memory associations than play money alone.

Challenges for Counting Mixed Money

Once your child masters counting like coins, introduce mixed money challenges that mirror real-life situations. These exercises develop the mental agility needed for everyday transactions.

Create counting scenarios with increasing complexity:

| Challenge Level | Coin Combination | Total Value |

| Beginner | 3 pennies + 2 nickels | 13¢ |

| Intermediate | 2 quarters + 3 dimes + 1 nickel | 85¢ |

| Advanced | 1 quarter + 4 dimes + 3 nickels + 7 pennies | 97¢ |

Start by having children sort the coins by type first, count each group separately, then add the totals together. As they improve, encourage them to count the highest-value coins first and work down—this strategy speeds up the process and reduces errors.

For an additional challenge, give your child a target amount (like 47¢) and ask them to create it using the fewest coins possible. This activity develops strategic thinking about coin values and combinations.

Games to Practice Making Change

Making change is where money counting becomes truly practical. Set up a pretend store at home where your child plays both customer and cashier. Price items between 1¢ and 99¢ using small toys or household objects.

The Sweet Shop Game: Label candy or treats with prices (gummy bears for 23¢, chocolate for 45¢). Give your child a dollar in various coins and have them “purchase” items, calculating both the cost and the change they should receive.

The counting back method: Teach children to count up from the purchase price to the amount given. If something costs 37¢ and the customer pays with two quarters (50¢), count: “37¢, plus 3 pennies makes 40¢, plus one dime makes 50¢—so the change is 13¢.”

According to financial literacy educator Yanely Espinal, “Children who learn to make change mentally develop stronger number sense and are better prepared for budgeting decisions later in life.”

Learn Money Math with Real-World Examples

Abstract math problems don’t always connect with children, but when you frame calculations using money, the concepts suddenly make sense. Money provides concrete context for addition, subtraction, multiplication, and even basic fractions.

Core Money Math Problems for Practice

Transform standard math worksheets into money-focused problems that feel relevant:

Addition: “You have 3 dimes in your pocket and find 4 nickels under the couch cushions. How much money do you have total?” (30¢ + 20¢ = 50¢)

Subtraction: “You saved 85¢ for a toy that costs 60¢. How much money will you have left?” (85¢ – 60¢ = 25¢)

Multiplication: “If one pencil costs 15¢, how much would 4 pencils cost?” (15¢ × 4 = 60¢)

Division: “You and two friends find 75¢. If you split it equally, how much does each person get?” (75¢ ÷ 3 = 25¢)

Create word problems based on your child’s interests. If they love sports, frame problems around buying baseball cards. If they enjoy art, calculate the cost of craft supplies.

Research from the European Journal of Educational Research indicates that students who learn math concepts through practical applications like money demonstrate 28% better problem-solving skills than those working with abstract numbers alone.

Using Games to Boost Financial Math Skills

Turn math practice into competitive fun with games that require quick calculations:

Coin Race: Roll dice to generate random amounts (roll a 3 and 5, make 35¢). The first player to correctly assemble that amount from a shared pile of coins wins the round.

Money Memory: Create matching pairs where one card shows coins and another shows the equivalent amount written numerically (one card has 3 dimes pictured, the other says “30¢”).

Calculator Challenge: For older children, use a real calculator alongside physical coins. They make purchases in your pretend store, calculate totals on the calculator, then verify their answer by counting out physical change.

Board games like Monopoly Junior naturally incorporate money math through buying properties, collecting rent, and paying bills. A single game provides dozens of addition and subtraction opportunities without feeling like schoolwork.

Setting Up a Class Store or Role Play

Creating a home or classroom store provides sustained practice with money in everyday situations. Stock your store with real items—snacks, school supplies, or small toys—and price them reasonably.

Getting started with your store:

- Price everything: Use price tags showing different amounts. Include some items under 25¢, some between 26¢ and 50¢, and a few premium items between 51¢ and 99¢.

- Create play money or use real coins: If using play money, make sure it accurately represents real denominations. Real coins provide better learning experiences when supervision allows.

- Rotate roles: Children should play both customer and banker. The banker role requires calculating totals and making change—the more complex task.

- Add complexity gradually: Start with simple one-item purchases, then progress to multiple items requiring addition, then introduce discount scenarios or sales tax (rounding to simple percentages like 10%).

One elementary school teacher in Portland reported that students who participated in a classroom store for just 15 minutes daily showed marked improvement in both math speed and accuracy. “They stopped seeing numbers as abstract concepts,” she noted, “and started understanding them as tools for getting what they wanted.”

Top Educational Games to Teach Money

Strategic game selection transforms learning about money from obligation into entertainment. The best games disguise education so well that children don’t realize they’re building crucial financial skills.

Board Games for Banking and Budgeting

Classic board games have taught financial concepts for generations, and modern versions offer even more sophisticated lessons:

Monopoly: The classic board game remains one of the most effective ways to teach banking basics. Players manage cash, calculate rent, make investment decisions, and learn that running out of money has consequences. The Junior version simplifies rules for children ages 5-8.

The Game of Life: This game walks children through major financial decisions—college costs, studcareer choices, insurance, loans, and savings. It demonstrates how early choices affect long-term financial outcomes.

Payday: Designed specifically to teach budgeting, Payday gives players a monthly salary and requires them to stay within budget while paying bills and dealing with unexpected expenses. According to game designer Paul J. Gruen, “Payday was created to show that earning money is only half the equation—managing what you earn determines financial success.”

Pay Day (the newer version) includes credit card mechanics that introduce the concept of borrowing and interest in age-appropriate ways.

For younger audiences, Money Bags teaches coin recognition and basic addition through collecting different coin combinations, while Exact Change challenges players to assemble specific amounts quickly.

DIY and Homemade Money Games

You don’t need commercial games to create engaging financial education. Homemade activities can be just as effective and can be tailored precisely to your child’s current skill level.

Piggy Bank Challenge: Give each child a piggy bank and establish ways to earn coins through age-appropriate chores around the house. Create a chart showing different tasks with corresponding payments (making bed = 5¢, feeding pet = 10¢, helping with dishes = 25¢).

Set a savings goal for something your child wants—perhaps a toy costing $5. Track progress visually with a thermometer chart that fills up as the piggy bank grows. This teaches delayed gratification and goal-setting alongside counting coins.

Money Bingo: Create bingo cards with different amounts written in each square (15¢, 30¢, 47¢, etc.). Call out coin combinations (“two dimes and three pennies”), and children must calculate the total and mark the corresponding square.

Price Tag Matching: Photograph items around your house, print the pictures, and have children assign reasonable prices. Then give them a budget (say, £20) and challenge them to go shopping through the photos without exceeding their limit. This activity encourages critical thinking about value and priority.

Coin Flip Trade Game: Each player starts with 10 pennies. Flip a coin—heads means trade 5 pennies for 1 nickel with the banker, tails means trade the nickel back for 5 pennies. First to accumulate 100¢ in any combination wins. This reinforces equivalency between different coins.

Online Games and Apps for Learning Money

Digital games online offer interactive experiences that adapt to each child’s pace, providing immediate feedback and progressive challenges.

ABCya Money Games: Free online games for elementary students covering coin identification, counting, making change, and comparing amounts. The visual interface is engaging without being overwhelming.

Bankaroo: This virtual bank app teaches children to track savings, set goals, and manage allowance. Parents can approve transactions, giving children independence within safe boundaries.

PiggyBot: Similar to Bankaroo, this app lets children divide allowance into “save,” “spend,” and “give” categories, introducing the important concept of charitable giving alongside personal financial management.

Financial Football: Developed by Visa, this game for older children combines sports with money questions. Correct answers advance the ball, making financial literacy competitive and exciting.

Peter Pig’s Money Counter: Designed by the U.S. Treasury, this game teaches American coin values through interactive counting exercises appropriate for ages 5-8.

Research posted on ResearchGate found that children using educational money apps for just 20 minutes weekly improved their financial literacy scores by an average of 19% over one semester.

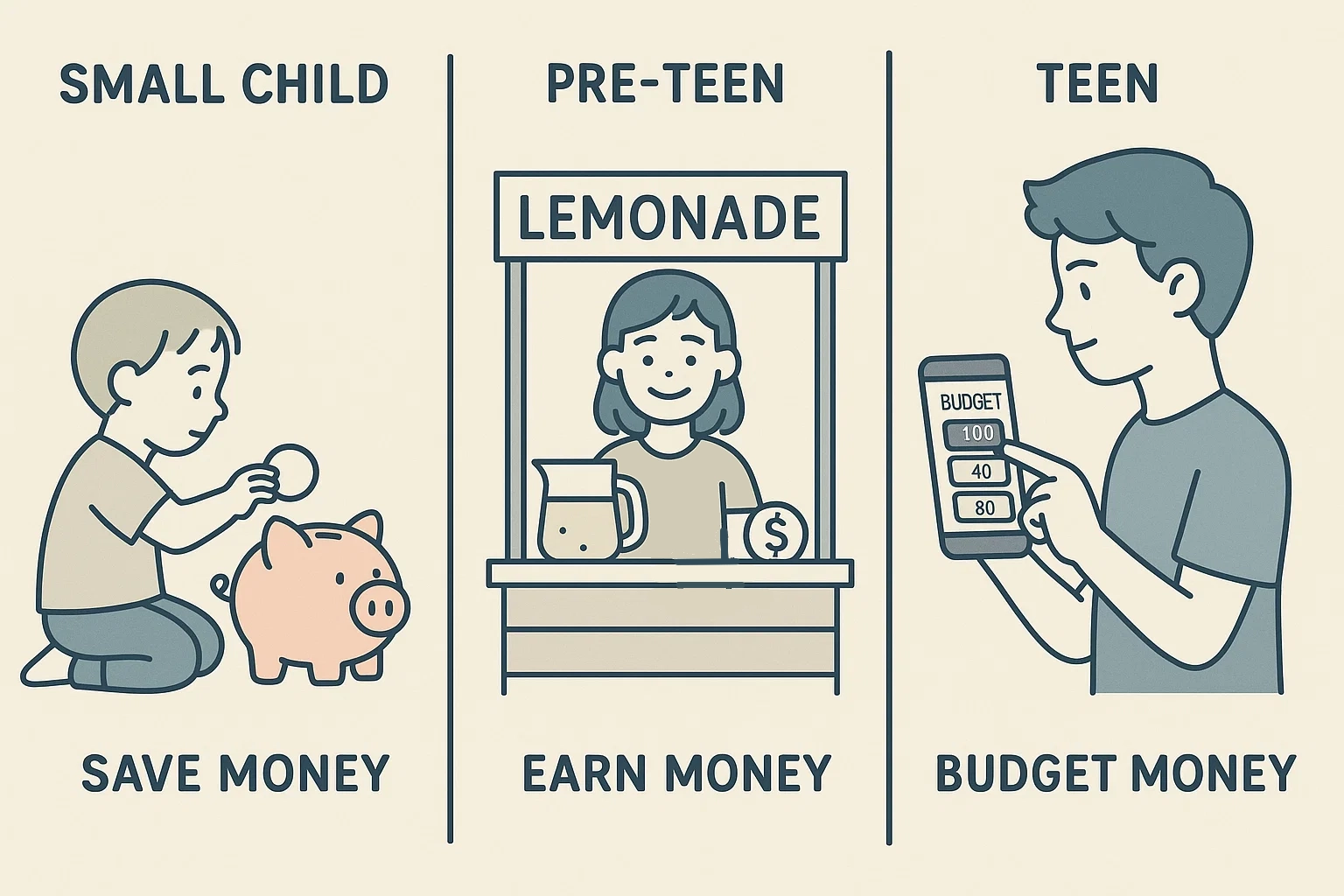

Boosting Financial Literacy by Age

Financial lessons must match developmental stages. What works for a kindergartener won’t engage a middle schooler, and expecting advanced concepts too early may frustrate rather than educate.

Laying the Foundations: Ages 3-5

Young children in this age range are concrete thinkers. They understand what they can see, touch, and experience directly.

Core concepts for early learners:

- Coin recognition: Teach children to identify pennies, nickels, dimes, and quarters by sight. Focus on visual differences—size, color, images on each coin.

- Basic counting: Start with pennies only, counting by ones. Once this is solid, introduce nickels and counting by fives.

- Value introduction: Use simple language like “this coin is worth one cent” (1¢) or “this coin is worth five cents” (5¢). Don’t expect young children to make calculations yet.

Age-appropriate activities:

Play “store” with just a few items, priced in round numbers (5¢, 10¢). Let them pay with exact change only—making change is too complex for this age. Use a piggy bank to introduce the concept of saving, but keep the focus on accumulating rather than calculating.

The goal isn’t mastery but familiarity and positive associations with financial concepts.”

Skills Practice: Ages 6-8

Children in early elementary grades can handle more complex calculations and begin understanding the relationship between different coins.

Developmental readiness at this stage:

- Skip counting: Most children this age can count by 5s and 10s, making nickels and dimes more accessible.

- Addition and subtraction: Apply these emerging math skills to money problems.

- Strategic thinking: They can plan coin combinations to reach specific amounts.

Effective teaching strategies:

Introduce the concept of earning through an allowance or payment for chores around the house. This creates a connection between work and money. Help them set savings goals for specific toys or treats, then calculate together how long it will take to save enough.

Use real money in everyday situations—let them pay for small purchases at stores and figure out if the change is correct.

Create math worksheets specifically about money, but keep them varied: “If you buy a pencil for 35¢ and a eraser for 20¢, how much do you spend?” or “You have 2 quarters and 3 dimes. Can you afford a candy bar that costs 75¢?”

Earning and Budgeting: Ages 9-12

Pre-teens are capable of abstract thinking and can grasp concepts like delayed gratification, opportunity cost, and long-term planning.

Advanced financial concepts for older children:

- Budgeting: Give them a weekly or monthly allowance and require they allocate portions to saving, spending, and giving.

- Earning vs. receiving: Distinguish between money given freely and money earned through effort. Many financial experts recommend shifting from allowance to earned income during these years.

- Opportunity cost: Teach that choosing to spend money on one thing means giving up something else. If they buy a video game, they can’t also get new shoes—helping them prioritize.

Practical applications:

Set up a family budget where children participate in discussions about household expenses. Show them bills and explain what things cost—electricity, groceries, car insurance. While you shouldn’t burden them with adult financial stress, appropriate transparency builds understanding.

Encourage entrepreneurial thinking. Can they earn pocket money through a lemonade stand, babysitting, or yard work for neighbors? These experiences teach that earning power often correlates with providing value to others.

Financial educator Beth Kobliner notes in her book Make Your Kid a Money Genius, “Children who understand budgeting by age 12 are significantly more likely to avoid credit card debt as young adults and establish healthy saving habits early.”

Create a “save or spend” decision log where they record purchases and reflect monthly on whether each expense was worthwhile. This builds the self-awareness necessary for mature financial management.

How Banking Concepts Help Children Learn

Banks seem abstract and intimidating to children, but introducing banking concepts early demystifies finance and establishes positive relationships with formal financial institutions.

Introducing Savings Accounts to Kids

A savings account transforms abstract saving into something tangible that children can track and watch grow.

Why savings accounts matter:

The account provides a clear destination for saved money and introduces the concept of interest—money that the bank pays you for keeping your savings with them.

Starting the conversation:

Explain that a bank is a safe place to keep money, much more secure than a piggy bank at home. Walk them through how deposits work: you give the bank your money, they keep track of it digitally, and you can take it out whenever you need it.

Introduce interest in simple terms: “If you leave your money in the bank for a while, they’ll give you extra money as a thank-you for letting them hold it. It’s not much—maybe if you save $10, they’ll give you 10¢ extra after a year—but over time, it adds up.”

Use online banking tools together, checking the balance regularly so they can see their account grow. This makes saving feel rewarding rather than restrictive.

Opening Child and Teen Bank Accounts

Most banks offer accounts designed specifically for young savers, often with no minimum balance requirements and no monthly fees.

What to look for in a child’s account:

- No fees: Children’s accounts should have no monthly maintenance charges, no minimum balance requirements, and no transaction fees for basic activities.

- Parental access: You should be able to monitor the account and approve transactions until they reach an appropriate age for independence.

- Educational resources: Some banks provide money lessons, games online, or printable materials to support financial education.

- Easy access: Online and mobile banking allow children to check their balance independently, promoting regular engagement with their finances.

The opening process:

Visit the bank together so the experience feels significant. Let your child participate in the paperwork (they can sign their name, even if you’re the actual account holder). Many banks give children a welcome kit with their first deposit slip and information about how banking works.

Calculate together how much money needs to go into the account each week or month to reach specific savings goals. If they’re saving for a $60 toy and can deposit $5 weekly, they’ll reach their goal in 12 weeks. This tangible timeline makes saving feel achievable.

Talking About Borrowing and Credit

Older children (typically ages 10 and up) can begin understanding that borrowing money creates obligations and costs.

Age-appropriate discussions about debt:

Start with the concept of borrowing in everyday life. If your child borrows a toy from a friend, they have to return it. Borrowing money works similarly—you have to return what you borrowed, but usually with extra money (interest) as payment for the loan.

Explain why people borrow: sometimes you need something now but don’t have enough money saved yet. Cars and houses cost so much that most people can’t pay for them all at once. Borrowing lets them get these necessities while paying over time.

The cost of borrowing:

Use concrete examples: “If you borrow $10 from me to buy a game, but you have to pay me back $11, is that a good deal? What if you had to pay back $15? At some point, the cost of borrowing makes it not worthwhile.”

Discuss credit cards honestly—they’re tools that let adults borrow money for short periods, but if you don’t pay the full amount back quickly, you’ll owe much more than you borrowed. Share that many adults struggle with credit card debt because it’s easy to borrow but difficult to repay with interest.

Teaching responsible borrowing:

If your older child wants to borrow money from you, create a simple written agreement. They borrow $5 for something specific, and they’ll pay back $5.25 over the next four weeks (25¢ represents 5% interest). They’ll experience firsthand that borrowing costs extra money.

Financial advisor Ron Lieber suggests, “Teaching children about credit before they need it creates a foundation of respect for borrowed money. Kids who understand borrowing costs are far less likely to fall into debt traps as young adults.”