Should allowance be tied to chores? Parents continue to debate whether money should be earned through household responsibilities or provided independently as a financial learning tool. The decision directly influences how children understand work, responsibility, and the value of money.

Behavioral research shows that linking payment to effort can strengthen financial awareness, while unpaid family duties support intrinsic motivation and empathy. An effective strategy often depends on age, family priorities, and the long-term skills parents aim to develop.

The Role of an Allowance 💰

An allowance serves as more than just pocket money—it functions as a child’s first introduction to personal finance and economic responsibility. When structured thoughtfully, allowances create opportunities for children to practice real-world money decisions in a safe, supervised environment.

Why a chore allowance is important

A chore-based allowance system introduces children to the fundamental concept that money is earned through effort and contribution. This connection between work and compensation mirrors real-world employment structures and helps kids understand that financial resources don’t appear magically.

When children receive money for certain chores, they begin to associate their efforts with measurable outcomes. This relationship can foster a strong work ethic early in life and help children understand that financial security requires consistent effort and responsibility.

How a chore allowance teaches kids about money

Money management skills develop through practice, not theory alone. A weekly allowance provides children with regular opportunities to make spending decisions, experience the consequences of their choices, and learn valuable lessons about saving and spending.

Children who manage their own allowance money learn to:

- Budget their available funds

- Distinguish between wants and needs

- Experience delayed gratification when saving for larger purchases

- Understand the finite nature of money

Giving kids an allowance builds responsibility

Financial responsibility extends beyond managing money—it encompasses reliability, commitment, and accountability. When kids earn their allowance through completing tasks, they develop a sense of responsibility that extends into multiple areas of their lives.

Children learn that their family members depend on their contributions. Whether it’s taking out the trash, setting the table, or keeping their room clean, kids begin to understand that their actions (or inactions) affect the entire household’s functioning.

This sense of responsibility often translates into improved performance in school, better relationships with peers, and increased self-confidence as children recognize their ability to meet expectations and contribute meaningfully to their family’s well-being.

The benefits of a chore-based allowance

| Benefit | Description | Long-term Impact |

| Work-Reward Connection | Links effort to compensation | Develops strong work ethic |

| Money Management | Provides practice with budgeting | Builds financial literacy |

| Responsibility | Teaches reliability and commitment | Improves overall accountability |

| Goal Setting | Enables saving for desired items | Develops patience and planning |

A chore-based allowance system helps kids learn the value of money while developing practical life skills. Children who understand that money requires effort are more likely to make thoughtful spending decisions and less likely to develop entitled attitudes about financial resources.

The Value of Unpaid Chores 🏠

While paid chores offer valuable lessons about earning money, unpaid household tasks serve an equally important purpose in child development. These contributions to family life teach children that some responsibilities exist simply because we’re part of a community that depends on mutual support and care.

Fostering a sense of family

Unpaid chores create opportunities for children to contribute to their family’s well-being without expecting a reward. This approach emphasizes that family members support each other because of love and shared responsibility, not because of financial incentives.

When kids participate in family chores without payment, they develop a deeper understanding of what it means to be part of a team. Simple tasks like helping with laundry, preparing meals together, or maintaining shared spaces become expressions of care rather than transactions.

Family therapist Dr. Richard Rende notes that children who participate in unpaid family responsibilities develop stronger emotional connections to their families and demonstrate greater empathy in their relationships with others.

What kids learn with chores without payment

Unpaid chores teach children valuable lessons that extend far beyond household management:

Intrinsic satisfaction: Children discover the personal satisfaction that comes from completing tasks well and contributing to something larger than themselves. This internal motivation becomes a powerful driving force throughout their lives.

Empathy and consideration: When children help without expecting payment, they begin to notice and respond to others’ needs. They might voluntarily help a parent who seems overwhelmed or assist a sibling without being asked.

Life skills mastery: Everyday chores like cleaning, organizing, and maintaining their environment become natural habits rather than paid obligations. These skills serve them well when they eventually live independently.

Chores build intrinsic motivation

Intrinsic motivation—the drive to act based on internal satisfaction rather than external rewards—represents one of the most powerful predictors of long-term success and happiness. When children complete chores without expecting payment, they develop this crucial internal compass.

Research by psychologist Edward Deci demonstrates that individuals who rely primarily on internal motivation show greater creativity, persistence, and satisfaction in their work compared to those driven primarily by external rewards.

Children who experience the satisfaction of contributing to their family’s well-being without payment often carry this intrinsic motivation into their academic pursuits, friendships, and eventual careers. They learn to find meaning and satisfaction in the work itself rather than relying solely on external validation or compensation.

Unpaid chores teach kids non-material values

Some of life’s most important lessons cannot be purchased or quantified. Unpaid chores provide opportunities for children to develop values like compassion, service, and community responsibility that form the foundation of strong character.

When a child helps their elderly neighbor rake leaves or assists with family meal preparation without expecting money, they learn that contribution and care are inherently valuable. These experiences shape their understanding of citizenship, community involvement, and personal integrity.

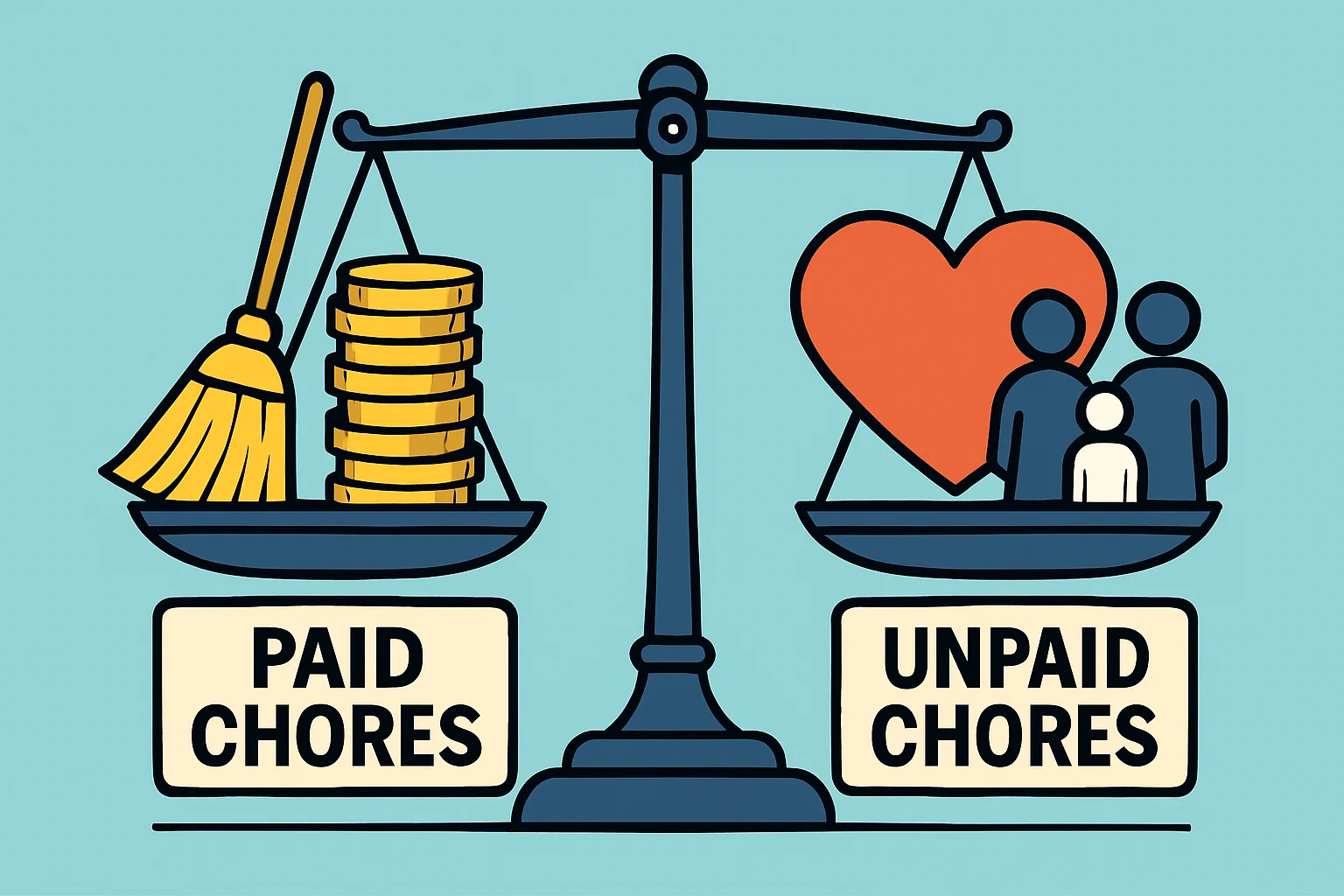

Paid vs. Unpaid Chores: Striking a Balance ⚖️

The most effective approach to chores and allowance often involves thoughtful integration of both paid and unpaid responsibilities. This balanced strategy allows children to learn about earning money while also developing intrinsic motivation and family commitment.

The goal you want to teach kids

Before establishing any chore system, consider what you ultimately want your children to learn. Most parents hope to raise children who are financially responsible, hardworking, caring, and capable of independent living.

These goals suggest that children need both:

- Experience managing money and understanding its value

- Opportunities to contribute without expecting rewards

- Practice with various life skills and responsibilities

- Development of strong character and family values

A balanced approach acknowledges that different lessons require different teaching methods. Some tasks may appropriately earn payment, while others represent basic family membership responsibilities.

Combining paid and unpaid tasks

Successful families often divide household responsibilities into categories:

Basic family membership tasks (unpaid):

- Keeping personal spaces tidy

- Putting away personal belongings

- Basic table setting and clearing

- Simple pet care responsibilities

- Helping with family activities

Extra contribution tasks (paid):

- Deep cleaning projects

- Yard work beyond basic maintenance

- Car washing

- Organizing family storage areas

- Helping with special events or projects

This division helps children understand that while they earn money for going above and beyond basic expectations, certain contributions are simply part of being a family member.

Chore payment vs. allowance

Families can structure financial compensation in several ways:

Direct payment per task: Children receive specific amounts for completing individual chores. This approach creates clear connections between work and payment but may lead to negotiations and transactional thinking about family contributions.

Weekly allowance tied to overall contribution: Children receive regular allowance payments based on their general helpfulness and completion of assigned responsibilities. This method emphasizes consistency and reliability while providing predictable income for money management practice.

Hybrid approach: Children receive base allowance for meeting basic expectations plus bonus payments for additional contributions. This system combines the benefits of regular income with opportunities for extra earning.

Age-appropriate chore expectations

Different developmental stages call for different approaches to chores and money management:

| Age Group | Appropriate Chores | Payment Considerations |

| 3-5 years | Putting toys away, feeding pets, setting napkins | Focus on habit formation; minimal payment |

| 6-8 years | Making beds, loading dishwasher, simple meal prep | Small allowance with guidance on spending |

| 9-12 years | Laundry, yard work, pet care, cleaning bathrooms | Larger allowance with saving requirements |

| 13+ years | Meal planning, budget shopping, car maintenance | Substantial allowance with budget responsibilities |

As children mature, their capacity for both work and financial understanding increases, allowing for more sophisticated chore and allowance arrangements.

Potential Issues with Paying Kids for Chores ⚠️

While chore-based allowances offer valuable benefits, they can also create unintended consequences if not implemented thoughtfully. Understanding common pitfalls helps parents avoid problems and maximize the positive impact of their approach.

Common mistakes when giving kids a chore allowance

Many well-intentioned parents encounter challenges when implementing chore allowance systems:

Inconsistent enforcement: When parents fail to consistently require chore completion or payment, children learn that agreements are negotiable and consequences are optional. This inconsistency undermines both work ethic development and money management lessons.

Payment without completion: Some parents pay allowances even when chores remain incomplete, often to avoid conflict or because they forget to check. This approach teaches children that they can receive rewards without meeting their obligations.

Micromanagement: Overly detailed oversight can prevent children from developing independent problem-solving skills and may create resentment about chore expectations.

Age-inappropriate expectations: Assigning tasks that are too advanced or too simple for a child’s developmental stage can lead to frustration, failure, or boredom.

Inconsistent chore follow-through

One of the most significant challenges families face involves maintaining consistent expectations and follow-through with chore completion. When children learn that they might receive their allowance regardless of their effort, the entire system loses its educational value.

Successful chore systems require:

- Clear, specific expectations about task completion

- Regular check-ins to assess progress

- Consistent consequences for both completion and non-completion

- Age-appropriate timelines for task completion

Parents who struggle with consistency might benefit from creating visual tracking systems, setting regular family meetings to discuss chore expectations, or involving children in creating household responsibility agreements.

When kids want to get paid for everything

A common concern among parents involves children who begin expecting payment for every contribution or favor. This attitude can develop when the boundary between paid and unpaid family contributions becomes unclear.

Signs that children are developing overly transactional attitudes include:

- Refusing to help without payment

- Negotiating for money before completing basic tasks

- Expressing resentment about unpaid family contributions

- Treating family members as potential clients rather than loved ones

Addressing this issue requires clear communication about the difference between earned income opportunities and basic family membership responsibilities. Parents may need to reinforce that some contributions flow from love and family commitment rather than financial arrangements.